how-to-spy-on-competitors-ads

How to Spy on Competitor Ads Using WinningHunter

By

Kinnari Ashar

Most ad testing fails for one simple reason. People start with ideas instead of evidence. They launch creatives, wait, tweak, and repeat, without ever knowing what already worked in their market. By the time something clicks, weeks are gone.

Competitor ads tell that story upfront, not in theory, but in real spend and real timelines. When you look at them the right way, patterns show up fast. What keeps running. What disappears. What keeps getting reused.

WinningHunter pulls those signals into one place, so research does not turn into a messy trail of tabs and screenshots.

This guide shows how to spy on competitors using WinningHunter, to read competitor ads with intent, not curiosity. If guessing feels expensive, this is where you stop doing it.

Key Takeaways

Competitor ad spying works only when treated as a system, not a one-time scroll. Random saves create noise.

Ads are signals, not answers. Longevity and repetition matter more than how polished an ad looks.

Creative patterns beat individual examples. One ad can mislead. Patterns across multiple advertisers rarely do.

Store and product context changes everything. Ads without revenue signals are incomplete data.

TikTok and Meta require different reading. Speed and trends matter more on TikTok, while structure and endurance matter more on Meta.

The goal is not to copy winning ads. It is to understand why they keep getting funded, then test those reasons deliberately.

What “Spying on Competitor Ads” Really Means (And What It Doesn’t)

Spying on competitor ads sounds more dramatic than it actually is. Many people assume it means peeking into another brand’s ad account and seeing hard numbers. That never happens. You cannot see the exact ROAS. Any tool claiming otherwise is selling fiction.

What you can see is advertiser behavior after money is spent. That is where the signal lives.

When an ad runs for weeks or appears in multiple formats, it usually passes internal checks. Advertisers move fast when something fails. They only keep what earns its place.

From there, research breaks into three clean lanes.

Creative spying - Focuses on how the message is delivered. Openings, formats, and angles that repeat across brands point to what reliably grabs attention.

Product spying - Shows what brands are willing to spend on. If a store sells ten products but advertises one consistently, that product likely carries the revenue.

Funnel spying - Looks at where the click leads. A direct product page suggests impulse buying. Longer pages or quizzes usually signal higher prices or more friction.

All of this data comes from ads brands chose to publish publicly or from aggregated patterns visible at scale. There is no access to private dashboards and no personal data involved.

Competitor ad spying is not about copying someone else’s work. It is understanding what the market already rewarded before you commit to your own budget.

7 Steps to Spy on Competitors Using WinningHunter

Step 1: Identify Competitors Using WinningHunter’s Dashboard

Competitor research starts by finding advertisers who are actively spending, not just the brands you already recognize. The goal here is simple: surface stores that are competing for the same buyer attention right now.

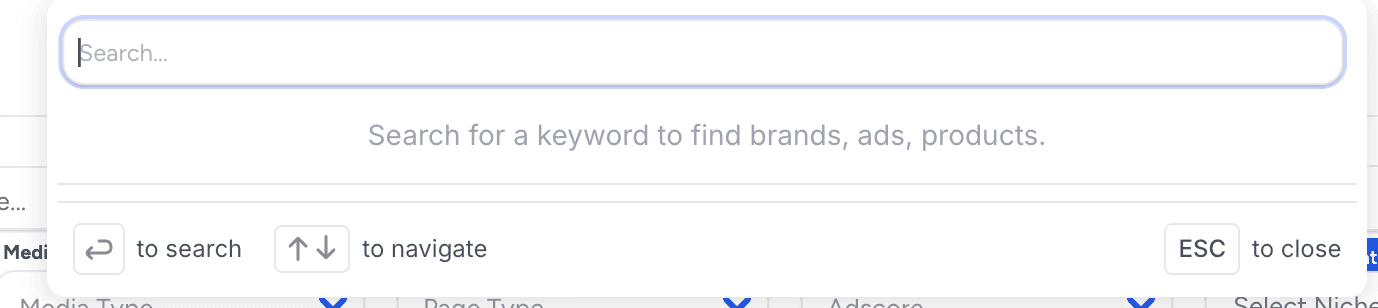

Begin with keyword-based searches inside WinningHunter. Use product-focused terms or problem-based phrases that customers would actually respond to in ads. For example, searching for a product category like ‘posture corrector’ brings up advertisers currently running creatives around that demand. This immediately exposes stores that may not rank on Google or appear in SEO tools.

Next, look for stores advertising similar products. Do not limit yourself to exact matches. Products that solve the same problem often compete in the same ad auctions. A back pain product, a posture device, and a massage tool can all target the same buyer mindset, even if the products look different.

Magic AI helps when you want to work backwards. You can use keywords to surface ads built around specific angles, or use images to find advertisers running similar visual styles. This is useful when a certain creative format keeps showing up, and you want to know which stores are behind it.

Step 2: Filter Competitor Ads to Remove Noise

Once you have a list of competitors, the next task is cutting it down. Most ads you see are not insights. They are short tests, half-baked ideas, or campaigns that never moved past day one. Filters are what turn a crowded feed into something usable.

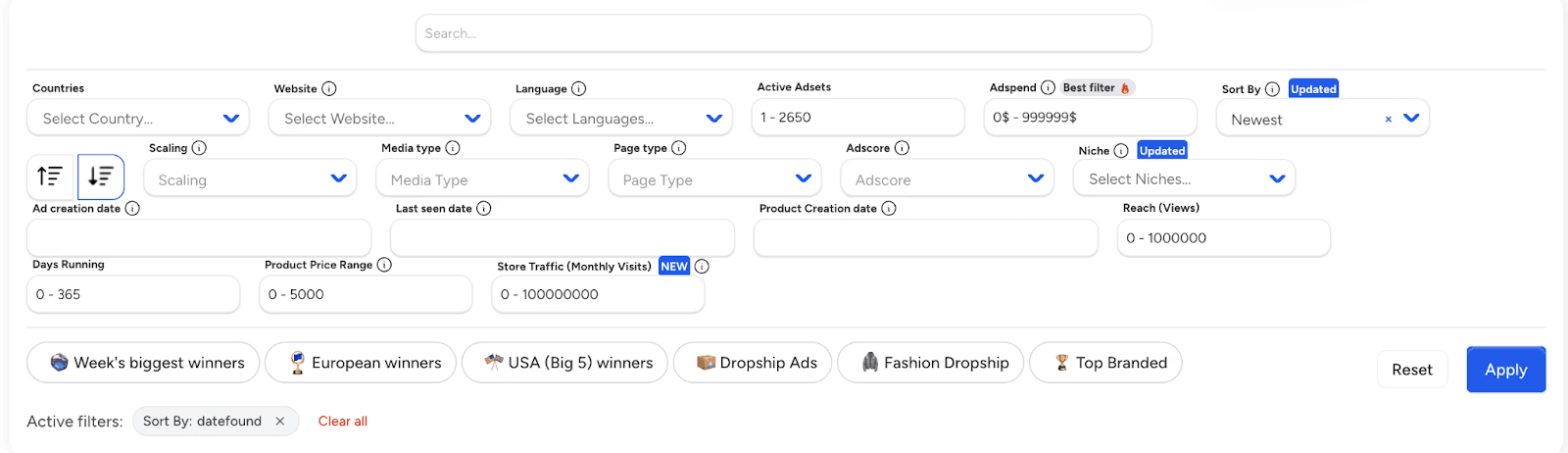

Start by filtering ads by platform inside WinningHunter. Facebook, TikTok, and Pinterest behave differently and reward different buying habits. Looking at them together blurs intent. Choose one platform and read only what belongs there.

It has many filters to ease the research.

Next, separate ads by status. Active ads show what brands are still willing to fund. Inactive ads are useful later for reference, but they rarely help you decide what to test next.

Creation date adds context. Newly launched ads are still being evaluated. Ads that remain live weeks later have already passed internal performance checks. Time removes weak ideas without you guessing.

Ad spend and ad set data help confirm seriousness. You are not reading revenue. You are reading intent. Ads duplicated across multiple ad sets usually indicate scaling, not curiosity.

Step 3: Analyze Creative Patterns Across Winning Ads

One ad can work by luck. Patterns do not. So, it’s best to look at ads in a cluster rather than just looking at one.

Look at what keeps repeating once you line up ads that stayed live.

Start with the opening. The first few seconds tell you what the advertiser believes stops the scroll. Some ads lead with a blunt problem. Others open with a result or a visual payoff. When the same opening style shows up across different brands, it is usually because the audience responds to it, so it becomes important to note.

Then look at how the ad is built visually. You will usually see one format dominate. Creator-style videos shot on phones. Simple slideshows. Straight product demos. If multiple advertisers rely on the same format, it is because it delivers consistently and not because it looks good.

Copy matters too, but more for structure than wording. Pay attention to how quickly the ad gets to the point and how the action is framed. Is the push about speed, ease, or reassurance? Repeated phrasing often reflects buyer hesitation being addressed, not brand personality.

Repetition is the real signal here. The same hook with different visuals usually means the angle works and the creative is being refreshed. The same offer framed in multiple ways usually means the advertiser is testing a presentation.

Step 4: Connect Ads to Stores and Products

Ads by themselves lie easily. A creative can look polished and get likes or even stay live for a while, and still belong to a store that barely sells. Without store-level context, ad analysis turns into guesswork.

This is where you move from creatives to the business behind them.

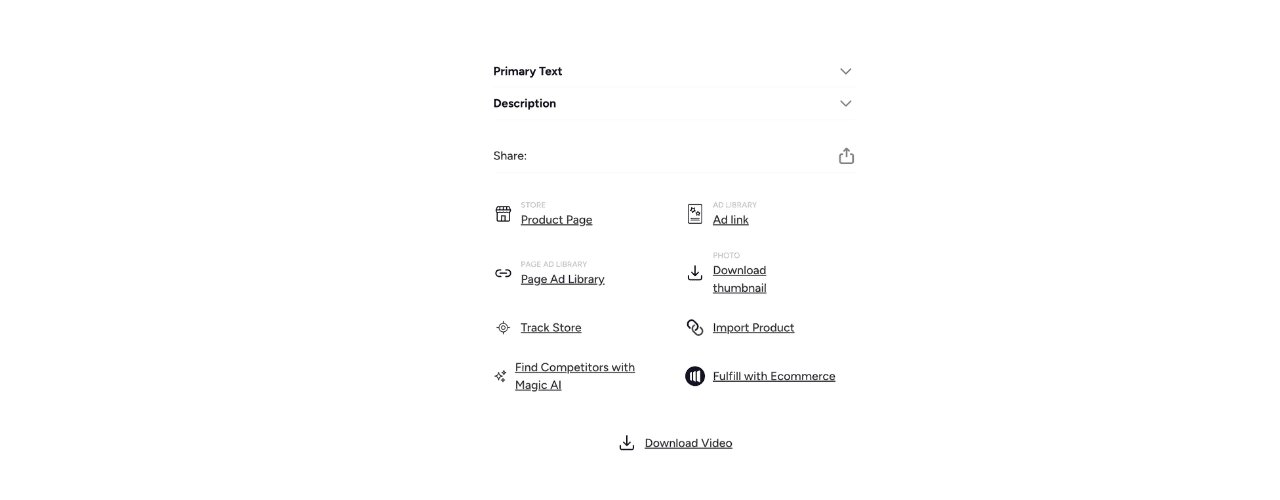

WinningHunter lets you connect ads back to the stores running them, which changes how you read everything. Instead of asking whether an ad looks good, you start asking whether it is attached to real revenue movement.

Using the sales tracker, you can estimate how a store is performing overall, then narrow that down to which products are being pushed through ads. When ad activity increases and revenue moves in the same direction, that relationship matters. When ads stay active, but revenue stays flat, that matters too.

This step helps surface two important signals. Stores that are scaling aggressively tend to increase ad volume while keeping the same core products in rotation. Products with consistent ad spend usually sit close to the revenue engine of the store, not at the edges.

A simple example makes this clear. If the same product shows up in ads across multiple stores during the same period, it is rarely random. Either demand is rising, or the product already proved it can convert.

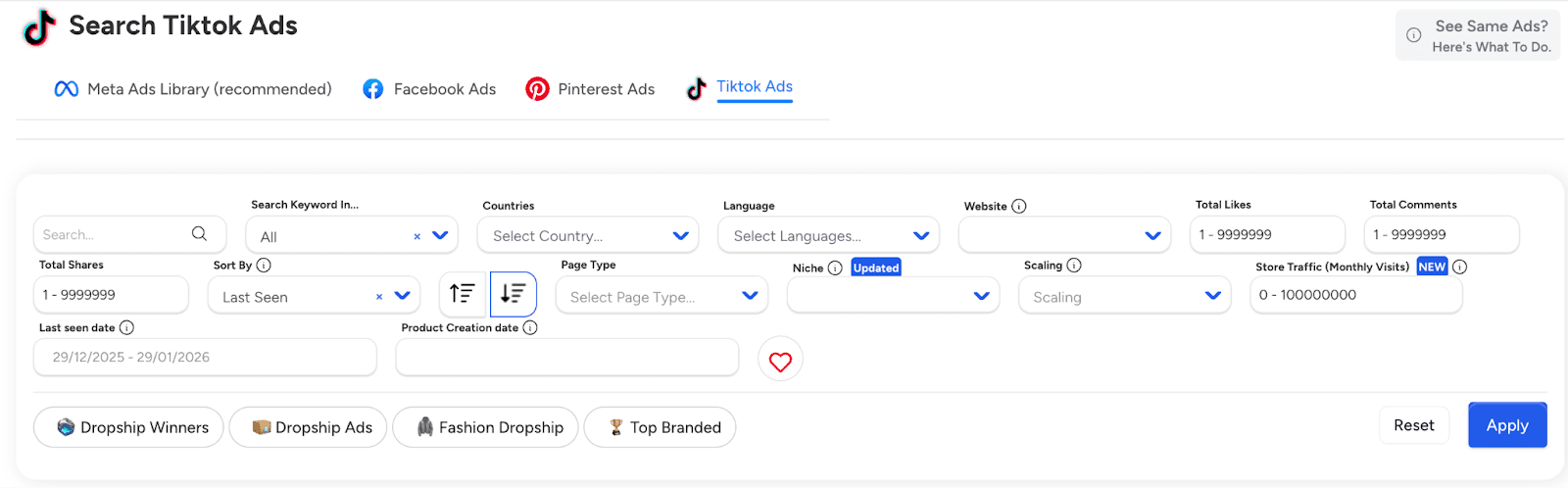

Step 5: Spy on TikTok Ads Using WinningHunter’s TikTok Creative Data

TikTok ads need to be read differently. What works on Meta often feels slow or forced here. Advertisers move faster on TikTok and abandon ideas without hesitation.

The biggest difference is pace. Creative rotation on TikTok is aggressive. Advertisers swap hooks, visuals, and formats constantly, not because the ads fail, but because fatigue hits quicker. An ad that runs for ten days on TikTok can already be considered mature.

Hooks follow trends more closely. Sounds, formats, and visual cues shift based on what users are already consuming. You will often see similar opening styles appear across unrelated brands within days of each other. That is not copying. That is platform behavior.

WinningHunter’s TikTok creative data, powered through Creative Center access, makes this easier to study in context. You can pull watermark-free videos to review them cleanly and focus on structure rather than surface-level aesthetics. This matters when you want to understand why a video works, not just how it looks.

Pay close attention to video styles that repeat across accounts. Short problem first clips, fast cuts, raw creator delivery, or product in hand demos often show up before they feel obvious in the feed.

Step 6: Track Competitor Trends Over Time

Ad spying only works once if you treat it like a one-time task. The real value shows up when you turn it into a habit. Trends do not appear in a single scroll. They reveal themselves when you watch the same space over time.

WinningHunter’s dashboard and saved filters help with that shift. Instead of starting from scratch every time, you can check the same niche weekly and see what actually changed. New advertisers entering the space stand out quickly. So do brands that quietly increase their ad presence instead of making noise.

A few signals matter more than everything else.

Ad volume creeping up - When more ads appear around the same product type or angle, it usually points to rising demand or improving margins.

Creative iteration instead of replacement - When advertisers keep tweaking the same idea rather than abandoning it, it suggests that the angle works and is being optimized.

Expansion beyond one platform - When ads move from one channel to another, it often means the advertiser is confident enough to scale and is not just experimenting anymore.

This is why consistency beats virality. Viral ads spike and vanish. Trends build slowly and stick around long enough to shape a market.

Step 7: Turn WinningHunter Insights Into Testable Campaigns

This is where most people slip. They collect good insights, then ruin them by copying what they saw instead of translating them into something usable.

Competitor research is not a script. It is a raw material.

What you take from WinningHunter should turn into test ideas. When you notice patterns, break them down into hypotheses you can actually validate. That usually means isolating what you observed.

You might translate insights like this:

A recurring opening style becomes a hook hypothesis

A dominant creative type becomes a format hypothesis

A repeated framing becomes an offer hypothesis

The key is restraint. Test one variable at a time. Change the hook but keep the format stable. Change the format but keep the offer constant. When too many elements move at once, results stop being useful.

Feedback loops should be short. Early tests are not about scaling. They are about direction. You want fast confirmation or fast rejection so you can move on without attachment.

Documentation matters more than people admit. Every test should be tied back to the pattern that inspired it. Note which competitors showed the behavior and what signal you reacted to. Over time, this creates a reference point you can return to instead of starting fresh every month.

Reading Competitor Ads Like a Marketer, Not a Spectator

Watching competitor ads is easy. Reading them properly takes intent. Ad spying only reduces uncertainty when it follows a system, not when it turns into tiresome scrolling and saving whatever looks impressive.

The workflow is simple when done right. Identify who is actually spending. Observe what stays live. Analyze what repeats. Validate it against store and product data. Then test with control. Each step trims guesswork.

WinningHunter fits into this efficiently. It shortens the distance between ads, stores, and performance signals so research does not fall apart across tabs, tools, scrolling, and screenshots. Less switching. Fewer assumptions. Clearer decisions.

The real goal was never to collect winning ads. Those expire fast. What lasts is understanding why certain ads keep earning budget while others disappear without a trace.

When you learn to read ads this way, you stop chasing outcomes and start recognizing causes.

FAQs

Is spying on competitor ads legal?

Yes. Ad spying relies on ads and storefront data that brands choose to make public or that platforms expose in aggregated form. You are observing market behavior, not accessing private accounts, targeting data, or personal information. But copying competitor ads is where the line is.

Can you see how much a competitor spends on ads?

No tool shows exact ad spend. What you see are directional signals like ad longevity, duplication across ad sets, and volume. Tools can show estimations only and the precise budgets.

How do you know if a competitor’s ad is profitable?

You never know for sure. Profitability is inferred through signals such as how long the ad runs, how often it is reused, and whether it aligns with store-level revenue movement.

What is the difference between ad spying and product research?

Product research focuses on what is being sold. Ad spying focuses on how it is sold and why traffic is being pushed there. Ads reveal demand and intent that product listings alone cannot show.

Do TikTok ads require a different spying approach than Facebook ads?

Yes. TikTok ads move faster and rely more on trends and raw creative. Facebook ads tend to scale more slowly and favor a clearer structure. Reading them the same way usually leads to wrong conclusions.

Can WinningHunter replace Facebook Ads Library?

Depends on the use case. For serious research, yes. Facebook Ads Library shows what is running. WinningHunter connects ads to stores and performance signals, which is what turns observation into decision-making.

We already know what works before you even have the chance to blink!

© 2024 WinningHunter.com