sell-the-trend-review

Sell The Trend Review (2026): Pricing, Data Accuracy & Real Use

Sell The Trend sells a tempting idea. Do everything from one dashboard and pay less while doing it. We went in curious but cautious. Cheap tools often look good until you rely on the data.

After testing Sell The Trend ourselves and comparing what we saw with real user feedback across forums and review platforms, one question kept coming up. Does the data actually hold up when you try to make decisions with it?

This review focuses on what showed up during real use, and not just what the landing page promises.

Quick Verdict

Score: 7.3/10 - A time-saving, beginner-friendly dropshipping platform that delivers strong usability and solid value at higher tiers. Data works best as directional guidance rather than precision insight.

What We Measured

Area | Score |

Ad Spy Features | 7/10 |

Database Accuracy | 6.5/10 |

Update Frequency | 6/10 |

Pricing & Value | 8.5/10 |

Ease of Use | 9/10 |

Support Quality | 7/10 |

Best for

New and intermediate dropshippers who want guided product discovery, automation, and fewer tools to manage while testing ideas quickly.

Skip if

You rely on exact sales data, want in-depth creative-level ad analysis.

What We Did to Test This

Before publishing this review, our Winninghinter team tested the tool the same way a store owner would use it in a real workflow.

Used Sell The Trend across multiple niches.

Reviewed and analyzed more than 100 user opinions from Trustpilot, G2, Reddit threads, YouTube comments, and all over the web.

Cross-checked product trends surfaced by the NEXUS engine against live ads and active store listings

Tested automation features such as product import, store sync, and fulfillment workflows.

This review reflects what showed up during actual use, supported by external feedback.

What is Sell The Trend?

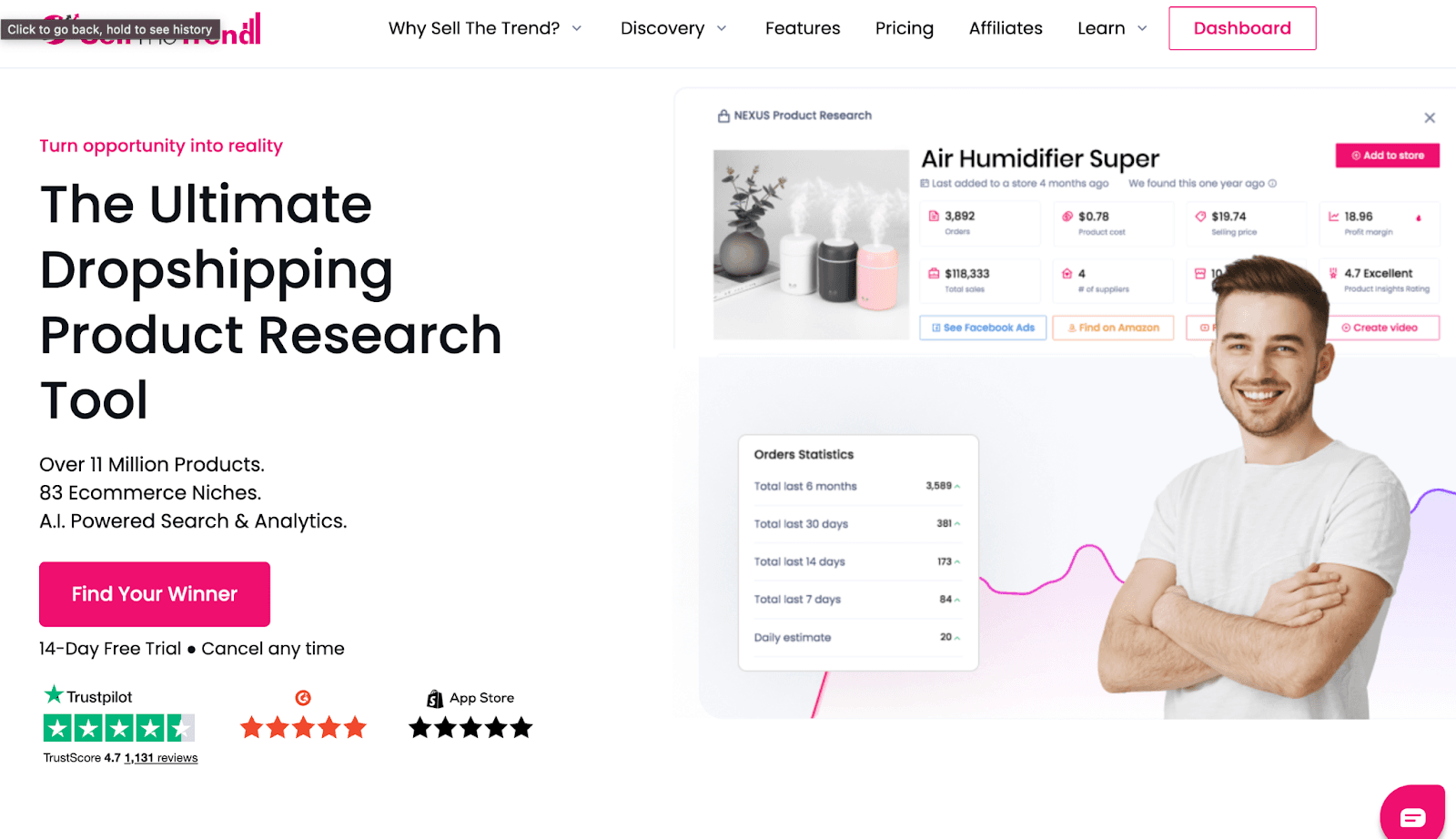

Sell The Trend is a dropshipping research and automation tool that tries to replace several steps of the research process with one dashboard. When we used it, the platform focused on helping you find products, check active ads, look at competing stores, and move products into a store without relying on multiple tools.

Sell The Trend combines discovery, basic analytics, supplier access, and automation features in one place. Their idea is to reduce the time spent switching between tools and deciding what to analyze next.

What Real Users Say

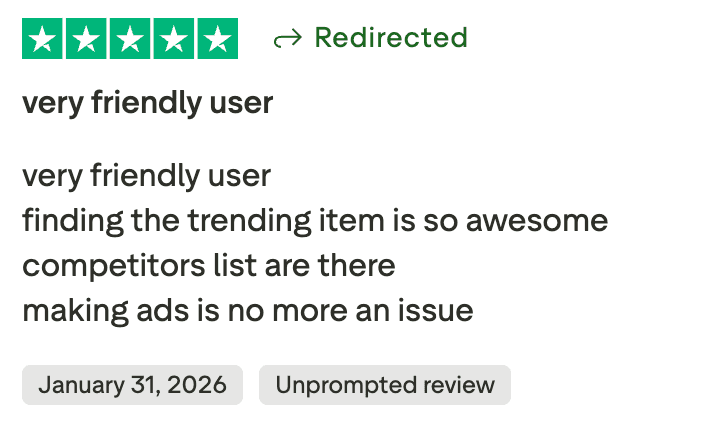

To balance our own testing, we analyzed feedback from Trustpilot, G2, Reddit discussions, and YouTube comments related to Sell The Trend. Instead of cherry-picking extreme opinions, we looked for patterns that kept repeating across platforms.

What Users Love

1. Product discovery saves serious time

Across review platforms, product discovery is the most common reason users say they keep paying for Sell The Trend. NEXUS Product Discovery comes up repeatedly as a time saver, especially among users who want to move quickly instead of digging through products manually.

Many reviewers describe finding viable products within days, sometimes even faster. One Trustpilot review specifically mentioned that the subscription paid for itself after identifying the first product early on. That sentiment appeared multiple times in different forms across platforms.

2. Beginner-friendly interface

There were many reviews stating that it’s really easy to use. Reviewers often mention that the dashboard feels organized rather than crowded, which makes it easier to understand where to start.

First-time users said that they were able to explore products without relying on tutorials or setup guides.

Our testing reflected the same experience. We moved from logging in to shortlisting multiple products in under thirty minutes. The interface stays out of the way, which helps you focus on evaluating products instead of learning the tool itself.

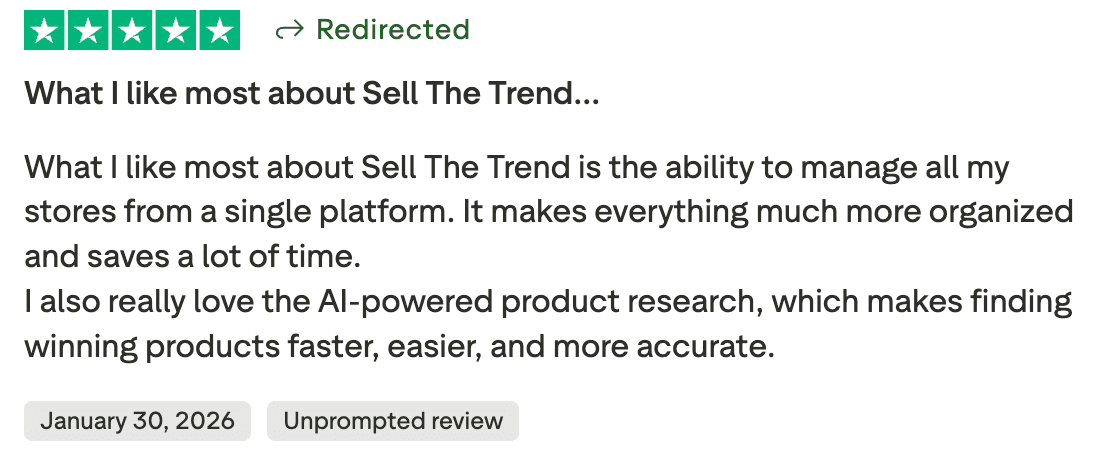

3. All-in-one convenience

Sell the trends claims to be an all-in-one convenience app, and the reviews agreed with it.

Reviews focused on managing multiple stores from one place and how that reduced routine work. It’s also mentioned finding a trending product, checking competitors, and moving straight into ad preparation without leaving the platform. These points came up independently, often written in plain language, which made them harder to dismiss as scripted feedback.

What becomes clear from reading the reviews is that convenience is not presented as a selling point. Tasks that usually feel fragmented are described as straightforward, which explains why this aspect of the tool comes up so often without much elaboration.

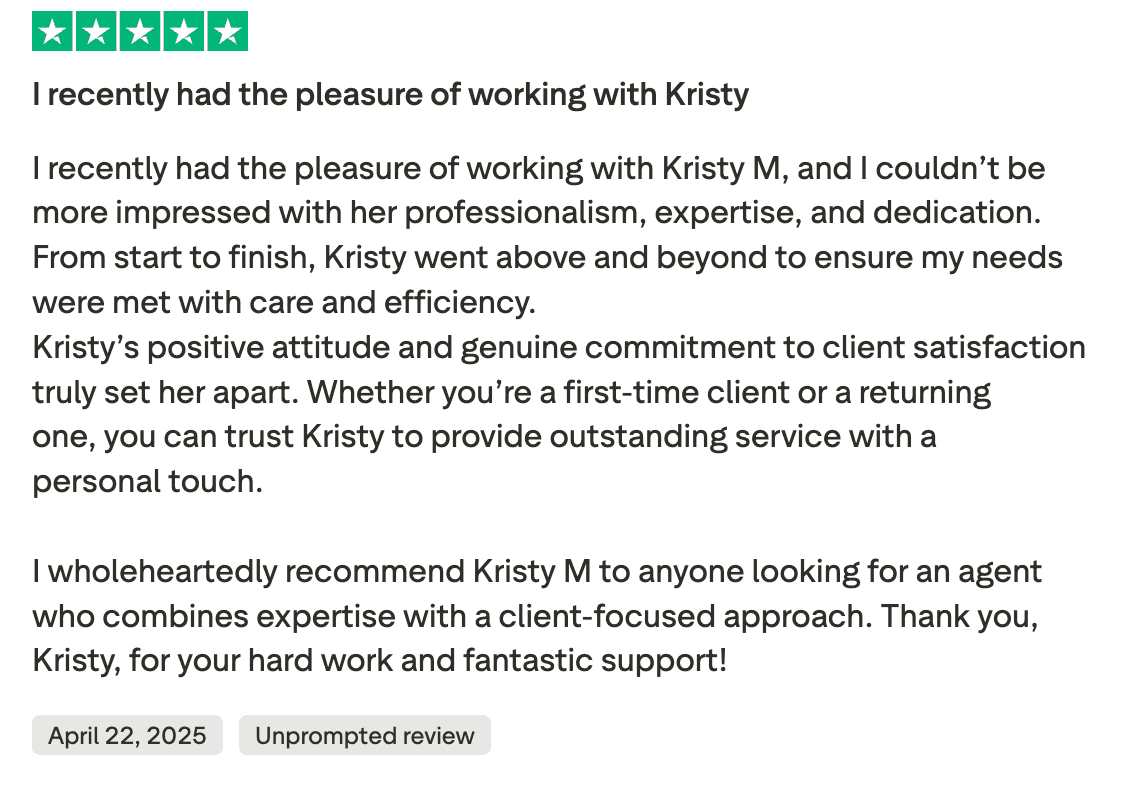

4. Responsive customer support

Support reviews stand out because they are specific. Users do not just say help was good. They describe who helped them and what was fixed. Names of support agents appear repeatedly, usually tied to billing problems, account setup issues, or questions that blocked progress.

Not all support-related reviews were positive, but most of them were on the plus side.

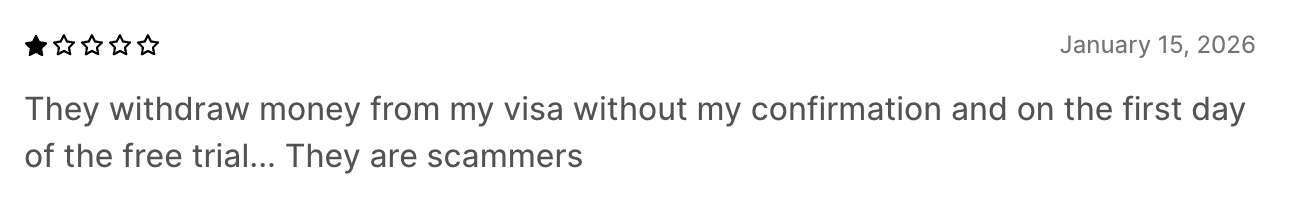

What Users Complain About

1. Pricing feels high for pure research

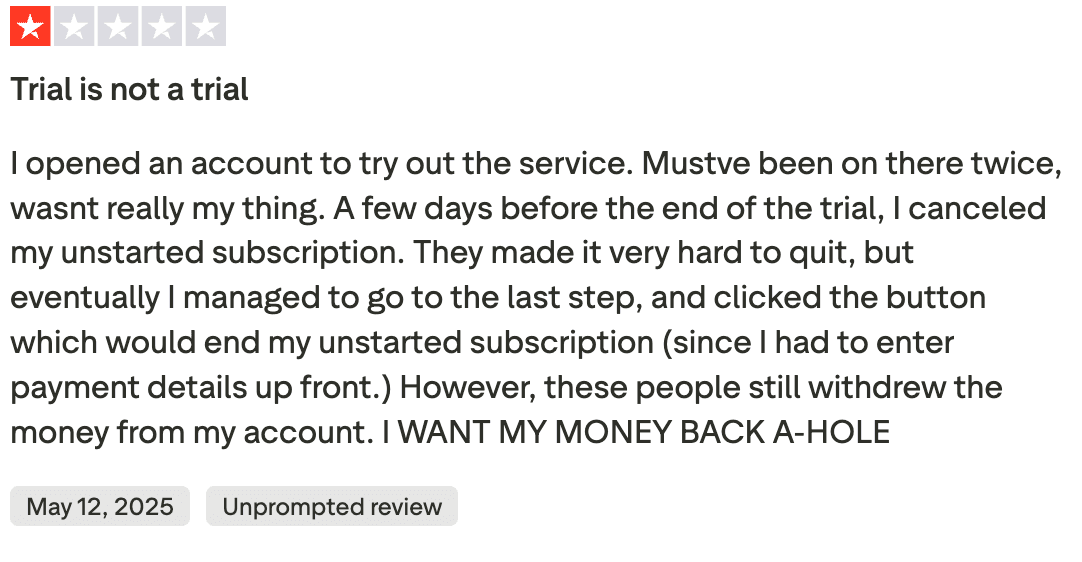

Billing complaints show up most clearly in Shopify App Store reviews. The frustration is not about pricing tiers, but about timing. Some users say they were charged as soon as the free trial ended without realizing cancellation needed to happen earlier.

A few reviews describe the charge as unexpected, with users saying they missed reminders or did not see clear prompts about when billing would begin. That confusion is what pushes the language in these reviews toward words like scammy, even when the issue appears tied to trial mechanics rather than missing features.

So we advise caution in this aspect.

2. Mixed Satisfaction; Some Users Not Impressed

Not all low-star reviews go into detail. On Trustpilot, some users simply say the tool did not meet expectations without pointing to a specific feature or failure. The feedback is brief and blunt.

These reviews usually do not accuse the platform of being broken or misleading. Rather, they suggest a mismatch between what the user expected and what they experienced after signing up.

The pattern here is subtle but consistent. When users expect the tool to do the thinking for them, satisfaction drops. For those cases, Sell The Trend feels less impressive because it does not replace judgment or experience.

3. Value Questioned by Some Reddit Users

In Reddit threads, the skepticism is not about features or bugs. It is about the approach. Some users openly question whether tools like Sell The Trend are worth paying for when you are still trying to understand how the business works.

The argument shows up in long, opinionated comments. These users prefer doing research manually because it forces them to learn who their customers are, why products sell, how competitors operate, and how offers are built. Relying on software to surface products is seen as skipping that learning phase.

Features Breakdown: What You Actually Get

1. Product Research (NEXUS)

NEXUS is the product research layer inside Sell The Trend. This is where products are surfaced based on activity, and we spent plenty of time researching here.

You can filter products using:

Engagement signals

Sales movement over time

Active ad presence

Store saturation

This makes it easier to narrow down ideas fast in use. Dead products drop out early, and anything showing some traction moves to the top.

Where NEXUS needs backup is validation. Products that looked promising inside the tool still required manual checks on live ads and real stores before they felt worth testing. As an idea generator, it saves time. As a decision maker, it still needs human judgment.

2. Ad Spy Tools

We tested the ad spy section inside Sell The Trend to see how much insight it actually gives beyond surface-level checks.

It lets you:

View active Facebook and TikTok creatives

See engagement around those ads

Check how long an ad has been running

What we found is that it works well for quick validation. We could confirm whether a product was actively being pushed and whether ads had any staying power without going too deep.

Where it felt limited was creative analysis. We could not break down angles, variations, or messaging in detail, the way standalone ad spy tools allow. For context and filtering, it does the job. For creative research, it stays basic.

3. Competitor & Store Intelligence

We tested the store analysis section to understand how reliable it feels when you use it for competitive checks.

You can look into stores to see:

Which products are selling the most

How pricing is structured

How product listings change over time

This helped us spot patterns across similar stores, especially around pricing ranges and product rotation. It gave enough context to understand how competitors position their offers.

Where caution is needed is in sales data. The numbers worked better as direction rather than precision. Treated as estimates instead of exact figures, the insights are useful. It should not be taken literally, as they can mislead.

4. Hand-Picked Winners

We also tested the Hand Picked Winners section to see whether it adds value beyond automated discovery.

This feature shows a short list of products selected internally rather than generated purely by filters. The products are already packaged with basic context like demand signals and selling angles, which makes scanning faster.

What worked well is speed. We didn’t have to sort through hundreds of items, you start with a narrowed list that feels curated. It is useful when you want quick ideas or a starting point without setting up filters.

Where caution is needed, trust. Since the selection process is not transparent, we treated these products as prompts, not recommendations. The ones that felt usable were still checked against ads and stores before being taken seriously. As a shortcut for inspiration, it helps. But as a final shortlist, it still needs validation.

Pricing: What It Actually Costs

Plan | Monthly Price (Monthly Billing) | Monthly Price (Yearly Billing) |

Essential | $49.97 | $32.97 (yearly) |

Pro | $99.97 | $66.64 (yearly) |

Pro+ | $299.97 | $199.97 (yearly) |

Each plan includes a 14-day free trial and can be canceled at any time.

Behind the numbers

Essential gives you core tools like NEXUS product research, hand-picked winners, Facebook ad finder, basic automation, and a limited store connection.

Pro unlocks TikTok ad finding, more daily picks, advanced filters, multi-store connections, and larger product import limits.

Pro+ is clearly aimed at heavier use, priority support, maximum stores, large product import capacity, and onboarding help.

We found the pricing feels steep if you only use product ideas occasionally. The Essential tier has value for exploration, but once you begin testing regularly, especially with ads and automation, the Pro tier tends to be where the tool starts making practical sense. Yearly billing drops the effective monthly cost on all plans, but the context you get matters more than the number itself.

Who Should Use Sell The Trend?

Sell The Trend works best when your goal is to reduce steps, not replace thinking. From testing the tool and reading user feedback, we could see the division. People who want structure tend to stay. People who want full control tend to leave.

Here’s a quick reference to who should and should not use:

Fits Your Workflow If You | Probably Not for You If You |

Want product research, ads, store checks, and automation in one place | Prefer building ideas entirely through manual research |

Like starting from filtered ideas instead of a blank screen | Expect precise sales numbers rather than estimates |

Use automation to speed up testing and store setup | Only need an ad spy tool |

Are fine paying for saved time and fewer tools | Need the lowest possible monthly cost |

What We’d Change

Sell The Trend does a lot right, but reading through critical reviews alongside our own use, we saw a few gaps that come up more than once.

Clearer billing and trial communication - A portion of negative feedback ties back to confusion around trial endings and charges. More visible reminders and clearer timing would likely prevent frustration before it starts.

Smoother onboarding for first-time users - The feature set is dense. Some users mention feeling lost early on because there is little guidance on what to use first. Short walkthroughs tied to common goals would help.

Stronger product saturation signals - Reviews point out that some suggested products already feel crowded. Better indicators around competition level or clearer saturation scoring would make filtering more reliable.

Deeper ad-level insight - For users focused on advertising, the current ad view feels surface-level. More context around performance or campaign behavior would make the ad data easier to act on.

More consistent support outcomes - Support is praised often, but a small number of reviews describe unresolved cases. Tightening consistency across responses would help match the overall reputation.

Support: What to Expect

Sell The Trend scored 7.3/10 in our analysis

Based on what we tested and what keeps repeating in reviews, support is one of the steadier parts of Sell The Trend.

Live chat is the main channel users talk about. Responses usually come quickly, especially for setup questions, billing clarifications, and account-level issues. Many reviews describe back-and-forth conversations that stay open until the problem is resolved, not one reply followed by silence.

Support works best for practical blockers. Things like trial confusion, store connections, imports, and basic workflow questions get handled without much friction. That lines up with our own experience reaching out with both simple and technical queries.

But there were a few negative ones as well, so it’s always best to stay cautious when your money is invested.

The Bottom Line

Sell The Trend does not hand you winning products, and it does not replace thinking. What it does well is cut down the number of steps between an idea and execution. Those time savings show up most clearly when you are juggling research, ads, stores, and imports across fewer tools. It makes your boring and tiresome work a bit better.

For the low price, it is good, but to get the best out of sellthetrend, you often need to increase your plan pricing.

Our recommendation: If you care about convenience, automation, and guided research, Sell The Trend is worth a serious look. It works best when you use the full workflow instead of cherry-picking one feature.

If your priority is exact data, deep ad analysis, or creative-level insights, a specialized tool will serve you better.

FAQs

Is Sell The Trend worth it?

Sell The Trend is worth paying for when you use more than one part of the platform. The value shows up when product research, ads, store tracking, and automation are used together. If you only want product ideas, the cost feels harder to justify.

Is Sell The Trend legit?

Yes. The tool has a long presence in the dropshipping space, active subscriptions, and consistent user activity across review platforms. Support is reachable, updates are ongoing, and the software behaves like a real product, not a short-term or abandoned tool.

Does Sell The Trend guarantee winning products?

No. It does not guarantee results. The platform surfaces signals and patterns, not outcomes. Products still need manual checks, creative testing, and offer validation. Treat it as a research shortcut, not a replacement for judgment or execution.

Does it have a free trial?

Trial availability and length change from time to time. Some users access a free trial, while others see limited access depending on plan and promotion. The safest option is to check the official pricing page before signing up to confirm current trial terms.

Can I cancel anytime?

Yes. Subscriptions run on a month-to-month basis. You can cancel from your account dashboard without contacting support. The main thing to watch is timing around trial expiration to avoid being charged unintentionally.

We already know what works before you even have the chance to blink!

© 2024 WinningHunter.com